I’ve been writing about this California Wealth tax proposal for a couple weeks now and I really thought I’d done justice to what a completely awful idea it is. Yesterday, for instance, I pointed out that this proposal is going so badly that Gov. Newsom is now making the media rounds to say ‘I told you so’ (almost literally). That comes after three of the state’s five richest billionaires have indicated they plan to leave the state to avoid the tax.

Today I learned that the tax is actually much worse than I thought it was. You see, I thought this was a 5% wealth tax. So the state would tally up everything you own and then just demand 5% of that total amount, including unrealized gains like ownership of stock you hadn’t sold.

But it turns out there’s a clause in the proposed law which makes things even worse. The site Pirate Wires has an explainer conveying how this works and why it could be the “kill switch” for California’s tech industry.

Late last year, the architects of California’s “Billionaire Wealth Tax” ballot proposition quietly amended language in their proposal which, if successful, would permanently end the concept of founder-controlled startups in the state — a technology industry kill switch…

Per the late November amendment:

“(C) For any interests that confer voting or other direct control rights, the percentage of the business entity owned by the taxpayer shall be presumed to be not less than the taxpayer’s percentage of the overall voting or other direct control rights.”

Don’t panic if that doesn’t immediately make sense. It didn’t to me either but here’s what it means. Common shares of stock in companies often convey voting rights to their owners, i.e. giving them some control of the company’s direction proportionate to their ownership. In many cases, those voting rights are distributed at one vote per share.

However, it’s quite common in Silicon Valley to have what is known as a dual-class stock structure. And that means that some special shares of stock, usually owned by founders and CEOs of the company, come with disproportionate voting rights.

As an example, Facebook has Class A shares and Class B shares. Investors hold Class A shares, but Mark Zuckerberg holds Class B shares, which have 10 votes each. His shares represent roughly 14% of Facebook’s economic ownership but control nearly 60% of the voting rights.

So there are special shares held by the founders of these companies that can have 10X the voting rights of common shares. So with that in mind, let’s read that clause from the wealth tax again.

“(C) For any interests that confer voting or other direct control rights, the percentage of the business entity owned by the taxpayer shall be presumed to be not less than the taxpayer’s percentage of the overall voting or other direct control rights.”

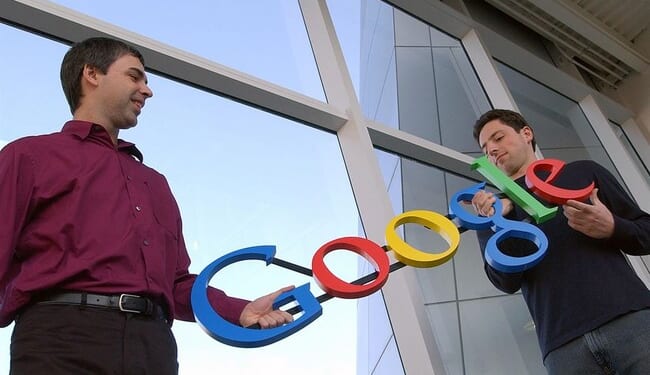

So what that means is you get taxed on your voting control of the company not your actual ownership. Venture capitalist Garry Tan explained how this would work out for someone like Larry Page, co-founder of Google.

Larry and Sergey can’t stay in California since the wealth tax as written would confiscate 50% of their Alphabet shares.

Each own ~3% of Alphabet’s stock, worth about $120 billion each at today’s ~$4 trillion market cap.

But because their shares have 10x voting power, the… pic.twitter.com/4DYDDmCDl4

— Garry Tan (@garrytan) January 9, 2026

Larry and Sergey can’t stay in California since the wealth tax as written would confiscate 50% of their Alphabet shares.

Each own ~3% of Alphabet’s stock, worth about $120 billion each at today’s ~$4 trillion market cap.

But because their shares have 10x voting power, the SEIU-UHW California billionaire tax would treat them as owning 30% of Alphabet (3% × 10 = 30%). That means each founder’s taxable wealth would be $1.2 trillion.

A 5% wealth tax on $1.2 trillion = $60 billion tax bill, each.

That’s 50% of their actual Alphabet holdings—wiped out by a “5%” tax.

This explains why both Larry Page and Sergey Brin have already made plans to leave California. Because, for them, this isn’t a 5% tax. It would actually take 50% of their remaining ownership of Google stock and something closer to 30% of their total wealth.

If the math still isn’t making sense, here’s a simplified version. In this case, the 5% tax could actually wind up taking half of everything you own.

If you own 10% of a company worth $10 billion dollars, but you have 10x voting rights, this ballot prop indicates you will be assessed as having a net worth of 100% of your company’s valuation. This means you will be taxed 5% of $10 billion dollars, rather 5% of the $1 billion dollars you are only theoretically worth. That is $500 million dollars.

Let’s say you’re a founder bringing in a few hundred thousand dollars a year. Hell, let’s say your salary is $1 million a year (unheard of). You now owe $500 million dollars. How are you going to pay this? Sure, you’re worth $1 billion… on paper. But that’s all just equity in your company, and that equity is all you have to sell.

So you try to sell half of your stake in the company you built. Under duress. This is to say, your absolute best case scenario here results in your having half of everything you own seized by the government. Worst case scenario, you can’t sell enough of your company to pay your tax bill, and you literally go bankrupt. There is a reason the government has never done this before, and it’s not because it’s scared of taxing people.

The author’s bottom line is that Silicon Valley, not the place but the idea of somewhere that is especially conducive to starting up new tech companies, can’t continue to exist in a world where tech founders can be completely wiped out at any moment by union activists. No one is going to want to keep doing this in California so long as this tax is hanging over them.

California has some great weather and some beautiful beaches, but at some point, the money will leave. It’s already starting to happen and the tax hasn’t even made the ballot yet.

As for Rep. Ro Khanna, he tells the Nation he’s not backing down.

“I was surprised by the freak-out over it,” said Khanna. “What I’ve tried to do is say, look. I celebrate builders. I celebrate entrepreneurs. I celebrate innovators. I understand that people have taken an extraordinary risk in creativity, and that’s a great thing. But there is a social contract to make sure there’s shared prosperity, and that is what we need.”…

“My values are with the working class and middle class in my district and around the country,” he said. “And I’m not going to be a coward or intimidated into compromising my values. And I think at this point, people want moral courage.”

Blatant theft requires a certain kind of boldness but it’s not moral or courageous. He is literally playing to the dumbest mob that exists at this moment, the dummies who believe billionaires are a sign something is wrong with the world.

Editor’s Note: Do you enjoy Hot Air’s conservative reporting that takes on the radical left and woke media? Support our work so that we can continue to bring you the truth.

Join Hot Air VIP and use promo code FIGHT to receive 60% off your membership.