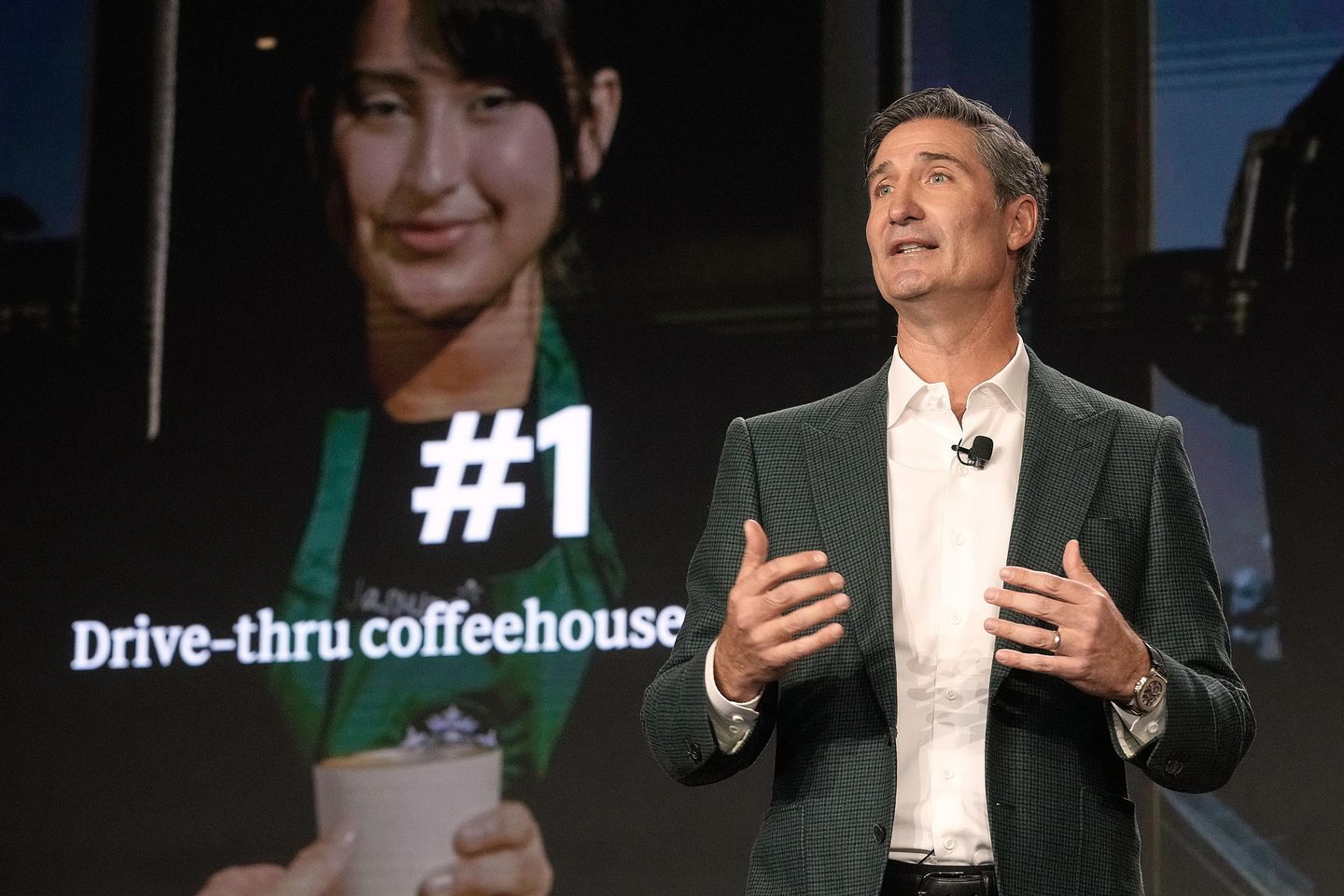

NEW YORK — Starbucks said Thursday that it plans to open hundreds of new stores across the U.S. and add seating capacity at thousands of existing locations, doubling down on a strategy of emphasizing the company’s cafes as community hubs even as consumer demand for drive-thru coffee grows.

The company unveiled its plans during a presentation in New York for investors. After announcing in September that it would close hundreds of less profitable stores, Starbucks said it now expects to open up to 175 new U.S. coffee shops this year and around 400 in 2028.

Its plans include smaller-format stores that are 20% cheaper to build but still offer comfortable seating, drive-thru service and mobile order pickup capacity.

Chairman and CEO Brian Niccol said Starbucks ultimately sees an opportunity to build at least 5,000 new cafes across the U.S., with the smaller store format presenting much of that opportunity. There are thousands of sites where no Starbucks operates within a mile of a competitor, he said. Starbucks is particularly eyeing the central, southern and northeastern U.S. for store development.

In some ways, Starbucks is running counter to a growing U.S. trend of drive-thru-only coffee shops such as Dutch Bros and 7 Brew. In September, the National Coffee Association, an industry trade group, found that 59% of U.S. coffee drinkers who bought coffee outside their home in the past week had used a drive-thru, which was an all-time high.

But Niccol said Thursday that over the last month, more than 60% of Starbucks’ customers came into a store to order their coffee, and he thinks it’s important for those stores to feel vibrant and inviting.

PHOTOS: Starbucks sees room to expand with hundreds of new US stores and increased seating

“Our cafes are our point of differentiation,” Niccol said. “We want people to be in our coffeehouses.”

Starbucks said it plans to add 25,000 additional seats to its U.S. cafes by the end of its fiscal year this fall. That’s part of an ongoing upgrade process that is intended to make existing stores warmer and more welcoming.

The improvements, which cost around $150,000 and are done overnight while stores are closed, have been completed at 200 locations and are expected to spread to 1,000 by fall. Starbucks expects to finish the retrofitting work in 2028. The company has around 10,000 company-operated stores in the U.S.

Niccol said Starbucks is seeing customers dwell longer in stores that are revamped.

Niccol, who joined Starbucks in 2024 to revive its flagging sales, said the company’s turnaround is taking hold. Starbucks has been adding staff and equipment to stores to improve service times and give employees more time to connect with customers.

Among Starbucks’ priorities in the coming year is improving its afternoon business, which is weaker than its performance in the morning. In the spring, the company plans to introduce customizable energy drinks made with a proprietary green coffee extract. It’s also planning more snackable foods that are high in protein and fiber, like flatbreads, cottage cheese and protein popcorn.

The company is also installing equipment designed to speed up service. A next-generation espresso machine will cut in half the 70 seconds it now takes to pull espresso shots and double capacity to eight shots at a time, the company said. The machines will begin rolling out to U.S. stores in 2027.

Starbucks also expects changes to its loyalty program to boost sales. A three-tiered program set to start March 10 in the U.S. and Canada will have various benefits for Green, Gold and Reserve members. Starbucks has 35.5 million active loyalty members in the U.S. alone.

Green members will still earn one star per dollar spent, and stars can be redeemed for food and beverages. But they will earn a $2 credit faster than before and get free drink modifications once per month, the company said.

Members who spend more will earn more perks. Reserve status members, who must earn 2,500 stars in 12 months, gain access to exclusive merchandise and events, including all-expense paid trips to coffee-focused destinations like Milan and Costa Rica.

Earlier this week, Starbucks reported stronger-than-expected sales in its fiscal first quarter. The company said its same-store sales were up 4% globally and in the U.S. in the October-December period, which marked its best U.S. performance in two years. It expects global and U.S. same-store sales to rise 3% in its 2026 fiscal year.

On Thursday, the company shared guidance for its 2028 fiscal year. It continues to expect U.S. and global same-store sales to rise 3% or more, and it expects revenue to grow by 5%. Starbucks also forecast earnings per share of $3.35 to $4. That compares to adjusted earnings per share of $2.13 in its 2025 fiscal year.

Starbucks shares fell 1% in midday trading Thursday.