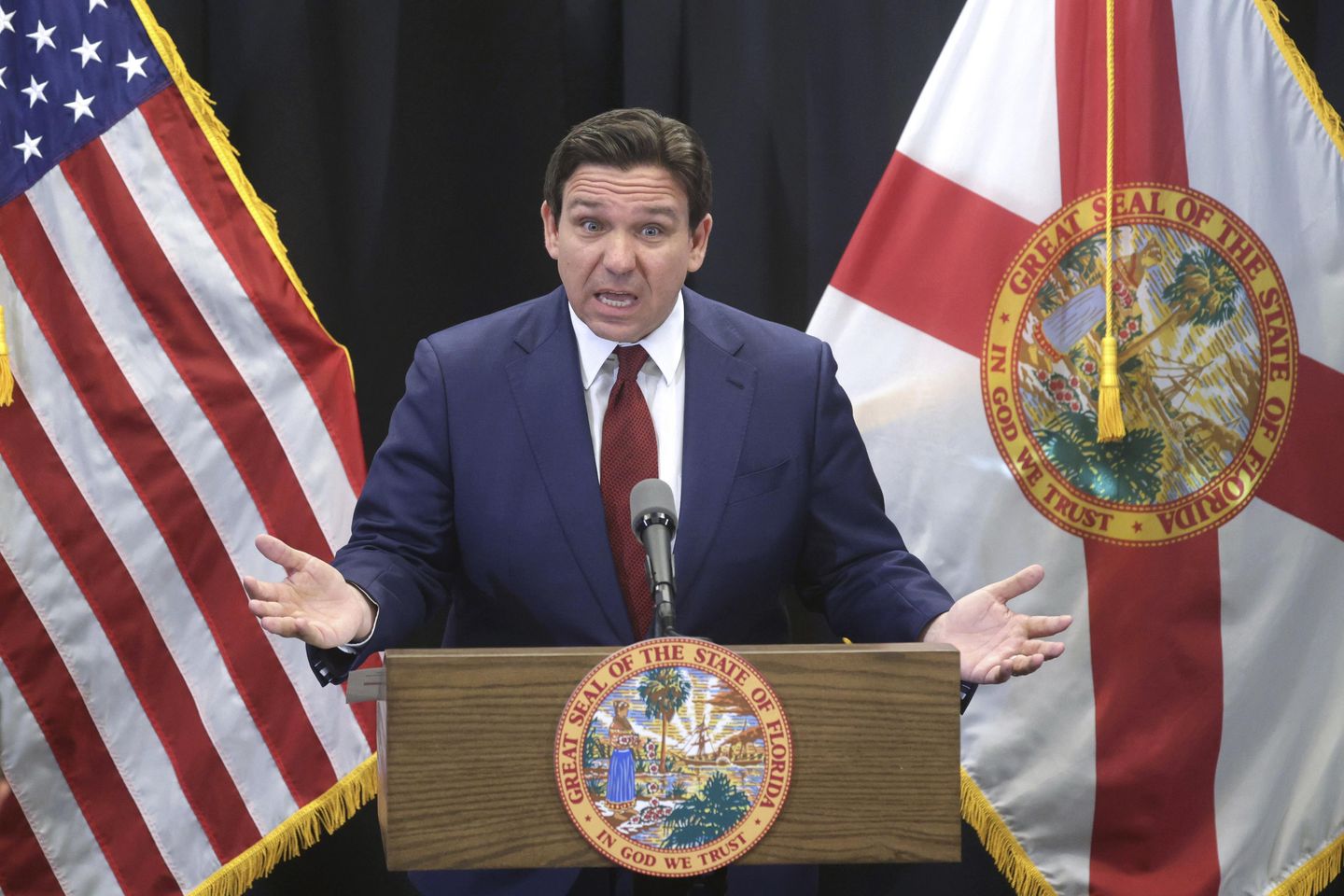

JACKSONVILLE, Fla. — Gov. Ron DeSantis is leading the charge in Florida to lower and eventually eliminate the property tax, which for many homeowners has added the equivalent of a second mortgage payment to their monthly expenses.

Mr. DeSantis likens property taxes to “perpetually paying rent to the government.” He said the taxes have steadily increased along with local government spending, making it impossible for seniors and other residents to afford to stay in their homes.

However, property taxes provide most of the funding for public schools, parks and the essential services of the fire and police departments in most of Florida’s 67 counties.

Property taxes provide Florida counties with more than $55 billion annually. The Tax Foundation said replacing the revenue would require increasing the state sales tax from 6% to 14%.

“Across the country, rising property tax bills have gotten a lot of attention. It’s become a political hot-button issue,” said Jared Walczak, vice president of state projects at the Tax Foundation.

Several other states, including Illinois, Kansas and Pennsylvania, are weighing initiatives to eliminate property taxes entirely. In response to public outcry, other states are working to reduce property taxes.

This month, the Texas Legislature agreed on a ballot measure that, if approved in November, would give seniors a $200,000 property tax exemption. All other homeowners would receive a $140,000 exemption.

Mr. DeSantis wants to provide rebates of up to $1,000 to permanent residents who pay property taxes on their primary residence. He is also pushing the Legislature to add a ballot initiative in 2026 that would let voters decide whether to cap or eliminate property taxes.

“It’s like you go buy a TV from Best Buy, you pay a sales tax, you put it on your wall, and then you watch it. You don’t keep paying taxes on it indefinitely,” Mr. DeSantis said at a recent roundtable to discuss his proposal. “So why is this something that we think is OK?”

Tampa retiree Kathy Gallo said her annual property tax amounts to an additional $529 monthly.

“That’s a huge sum of money for someone who’s on a fixed income,” she said.

Like other Florida residents, Mrs. Gallo is also paying higher homeowner insurance rates, which have been steadily increasing because of roofing scam lawsuits and storms.

To keep her house, Mrs. Gallo and her husband have ditched their second car, which was “excruciating,” she said at the roundtable discussion on taxes. The couple cut cable TV and made other adjustments to reduce expenditures.

“What I would like to see is for our elected officials to think about, when they raise taxes, is where that money is coming from. It’s coming from people like me.”

Property taxes in Florida are implemented in millage rates that amount to roughly $1 in taxes for every $1,000 in a home’s assessed value.

Owners of a $500,000 home would pay $5,000 in property taxes on average.

Many states, including Florida, have limits on how much counties can raise property taxes on homeowners. In Florida, the maximum is 3% per year, but only for those who use their home as a primary residence.

For longtime homeowners, the cap has helped keep down property taxes, but over the years, the slow and steady increase adds up, especially as home values climb.

It’s much worse for new homeowners. They face a massive property tax increase because the rate is reset at the home’s market value.

The increased tax adds hundreds of dollars to monthly payments for first-time homebuyers.

Florida TaxWatch, a nonpartisan tax watchdog, said property tax collection in Florida has increased by more than 108% over the past decade, based on state figures.

Most of the increase was levied by school boards and county governments, which needed revenue for hiring, raising salaries, and expanding services and schools related to the state’s significant population growth.

Florida and eight other states have no income tax to help pay for government services, which limits the options for offsetting the property tax.

Mr. DeSantis has pitched the idea of the state subsidizing counties that are the most heavily reliant on property taxes as they transition away from the taxes as a source of revenue.

In Nassau County, in northeast Florida, spending increased by $23 million last year, or 5%, partly to accommodate a 30% population growth over the past decade, county officials said.

Property taxes comprise more than 60% of the county’s general fund.

The county lowered the millage rate slightly, but rising property values, fueled by an influx of new residents who drove up real estate prices, nonetheless led to higher property taxes.

“Property taxes are going through the roof,” TaxWatch President and CEO Dominic M. Calabro said. “It’s really squeezing out a lot of people with moderate incomes.”

A committee of more than three dozen lawmakers in the Florida Legislature is examining proposals to reduce property taxes but has not come up with a formal proposal. The committee also hasn’t shown much interest in Mr. DeSantis’ property tax rebate proposal, which he hoped would result in the state issuing checks for homeowners by December.

Mr. DeSantis said he would veto a proposal in the Legislature to reduce the sales tax by a quarter of a penny. He said the tax break would mostly benefit tourists and sink any effort to cut property taxes for lifelong homeowners in the state.

Mr. Walczak, of the Tax Foundation, said it would be difficult to abolish property taxes in Florida, especially in rural counties that are almost wholly reliant on the taxes to fund the government.

Nationwide, property taxes account for more than 70% of all local tax revenue.

“It’s very hard to replace, and almost anything you replace it with would be less economically competitive. Whether that was a local income tax or a much higher local sales tax,” Mr. Walczak said. “Those would all be worse for the community than the property tax.”