Imagine a master chef who once dazzled the world with precision and flair is now cooking in a dim kitchen with dulled knives and missing ingredients.

He still wears the uniform and bows gracefully, but behind the curtain, he’s burning through recipe books, hoping something new will stick.

That’s Japan’s economy. Once the envy of the world, it is now an aging giant weighed down by demographic decline, bureaucratic caution, and decades of policy whiplash.

And in a surprise move, Japan’s biggest steelmaker bet nearly $15 billion on American industrial might.

The Nippon Steel–U.S. Steel acquisition isn’t just a business deal; it’s a flare signal from a nation desperate to reclaim a place at the economic table.

Setting the Record Straight: It Wasn’t the Tariffs

Let’s begin by clearing the fog.

You’ll hear pundits on cable shows or read headlines from coastal editorial boards parroting a tired line: that President Trump’s tariffs somehow crippled Japan’s economy, bringing a proud industrial nation to its knees.

It’s a convenient tale for those allergic to economic nuance and eager to turn every global downturn into a Made-in-Mar-a-Lago crisis.

But it’s fiction. Plain and simple.

Japan’s economic struggles didn’t begin with Trump’s tariffs; they started nearly three decades before.

Long before Trump even considered politics, Japan was already battling structural deflation, bloated government debt, declining birth rates, and a manufacturing sector weighed down by overregulation and domestic stagnation. The real economic hit came from within, not from American trade policy.

If anything, Trump’s targeted tariffs on steel and aluminum are aimed primarily at China. Strategic carve-outs and negotiations allowed trusted allies, including Japan, to maintain favorable trade terms where mutual defense and economic goals aligned. And when the tariffs were applied, they were surgical, not systemic.

Japan’s economic decline has been slow, internal, and self-inflicted. It results from demographic inertia, institutional hesitation, and decades of policy that put consensus above courage.

This column isn’t about defending Trump. It’s about protecting the truth. The truth is that Japan’s economy was unraveling long before a single tariff was signed. To argue otherwise is to confuse a symptom for the disease.

The Bubble Years: When the Sun Rose Too Fast (1980–1991)

The 1980s in Japan felt like a victory parade. After rising from the ashes of World War II, Japan became the second-largest economy in the world by 1987. Its automakers and electronics giants, Toyota, Sony, and Panasonic, dominated global markets. Western media portrayed Japanese businessmen as disciplined, tireless, and even ruthless. The country’s efficient, export-driven economy had become the model others sought to replicate.

But behind the scenes, financial deregulation and loose monetary policy quietly inflated a bubble.

After the 1985 Plaza Accord, the yen appreciated sharply, by nearly 50 percent within two years. That hurt Japan’s exporters, who had driven the nation’s postwar boom. The Bank of Japan slashed interest rates to cushion the blow, unleashing cheap money into the system. That flood of liquidity didn’t go into productivity or innovation; it went into real estate and stocks.

Speculation became absurd. In Tokyo’s Ginza district, property prices reached over $1 million per square meter. The Nikkei stock index soared to nearly 39,000 by the end of 1989. Japanese banks, flush with inflated collateral, lent with abandon. The myth of limitless growth blinded regulators and executives alike.

When the bubble burst in 1990, it wasn’t just wealth that vanished. Confidence collapsed. Real estate values sometimes fell by over 80 percent. The Nikkei lost half its value in months and never fully recovered. A national psychological downturn followed, and no interest rate cut could be reversed. Japan had flown too close to the sun, melting the wax fast.

The Lost Decades: Zombie Firms and Policy Paralysis (1991–2010)

The 1990s brought the “Lost Decade,” a phrase now outdated only because Japan never really left the woods. As asset prices plummeted, banks sat on piles of bad loans, refusing to call in debts or shutter insolvent businesses. The result: “zombie firms” that absorbed capital, but produced little.

Leadership in Tokyo responded with tepid stimulus packages, half-hearted deregulation, and a hesitancy to impose market discipline. Prime ministers came and went like revolving doors. Confidence waned. By the mid-2000s, deflation had become not just an economic condition, but a psychological one.

People stopped spending, not because they lacked money, but because they believed things would cost less tomorrow. A consumer culture rooted in restraint became an economic handbrake.

The Abe Years: Abenomics and the Limits of Ambition (2012–2020)

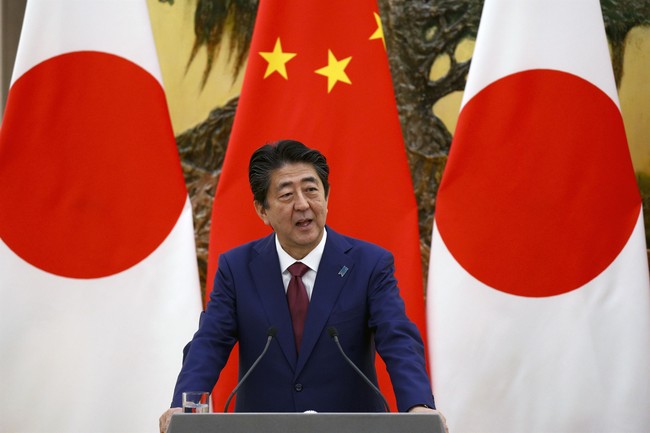

Shinzo Abe didn’t just return to office in 2012; he stormed back with a mandate to end Japan’s prolonged slump. Having previously served a short and rocky term in 2006–07, Abe emerged as a more focused leader. He saw Japan’s crisis not just in economic terms, but existential ones. If something radical wasn’t done, Japan wouldn’t just decline; it would disappear.

Abenomics, his signature strategy, was built on “three arrows:”

- Aggressive monetary easing by the Bank of Japan to defeat deflation.

- Flexible fiscal policy to jumpstart demand through government spending.

- Structural reforms to revamp stagnant sectors and modernize labor markets.

The first two arrows were fired with gusto. The BOJ began purchasing long-term government bonds at an unprecedented scale. Negative interest rates arrived. Asset prices rose. Corporate profits rebounded. Tourism boomed. And Japan’s job market tightened, hitting its lowest unemployment in decades.

But the third arrow? Structural reform barely cleared the bow.

Attempts to liberalize agriculture, expand childcare access, and integrate more women into the workforce yielded modest returns.

The deep-rooted dual labor system remained largely untouched, where permanent employees had job security while contract workers were disposable. Immigration policy was softened slightly but never embraced.

Still, Abe was consequential. He restored political stability, expanded Japan’s international presence, and pursued bold central bank coordination that reshaped how global economists understood monetary tools. But in the end, he couldn’t reverse Japan’s demographic destiny or awaken its private sector from risk-aversion.

COVID and the Age of Shrinking Options

By 2020, Japan was already teetering on the brink of long-term contraction when the COVID-19 pandemic arrived. Initially lauded for its restraint-based response, no lockdowns, and minimal disruption, Japan avoided the death tolls seen elsewhere. But the pandemic was a spotlight, exposing every weakness the country had ignored.

Tourism, once a bright spot, disappeared overnight. Over 30 million annual visitors are gone. Small towns that had leaned into heritage tourism and regional festivals were in financial ruin.

While accessible, the healthcare system showed cracks. Overcentralization led to supply shortages. The elderly were at the highest risk, and Japan’s population was the oldest.

Domestic consumption cratered, and exports faltered amid global shutdowns, causing Japan’s GDP to shrink by over 4.5% in 2020. Meanwhile, government spending ballooned, pushing public debt even higher, already the worst in the developed world.

What was left was a sobering truth: even when faced with a global crisis, Japan’s core economic vulnerabilities, demographics, debt, and bureaucratic rigidity could not be papered over.

Nippon Steel’s $14.9 Billion Gamble: More Than a Merger

Enter the recent announcement: Nippon Steel will gain U.S. Steel for nearly $15 billion.

For some, this felt like déjà vu. Japan Inc. has a checkered history with U.S. investments, Toshiba and Westinghouse, SoftBank, and WeWork. But this is different.

Here’s why this deal matters:

- Strategic Market Access: Japan’s domestic steel demand has nearly halved since the 1980s. Meanwhile, the U.S. is in the middle of an infrastructure renaissance. By buying U.S. Steel, Nippon isn’t just acquiring assets; it’s embedding itself in the next American manufacturing boom.

- Technology Leverage: Japanese steelmaking is clean, efficient, and technically advanced. U.S. Steel’s older plants need an upgrade. If the integration works, this deal becomes a proof-of-concept for Japanese industrial superiority.

- Domestic Economic Impact: The profits may not directly count toward Tokyo’s GDP, but the move boosts investor confidence and signals that Japanese corporations still dare to think globally.

- Trade and Political Complications: There are clouds, too. American regulators may balk. Labor unions are already uneasy. And in today’s populist climate, the idea of a Japanese firm owning a legacy American brand will not sit well with some lawmakers.

But if managed well, this could become a watershed where, stagnant at home, Japanese capital finds new purpose abroad.

Closing: A Chef in the Dark Kitchen

Let’s go back to the chef.

He once stood at the center of the culinary world, his dishes imitated from Paris to Buenos Aires. His knives were sharp, his ingredients fresh, and his name alone commanded respect.

But today, he works in dim light. His tools are worn. The spices he once imported are unavailable, and the guests stopped coming years ago.

And yet he still shows up every day.

The Nippon Steel–U.S. Steel deal may not save Japan’s economy, but it is the act of a chef reaching for a new recipe.

It is a country saying, “We are not done yet.” It shows that Japan can still think big, even when it feels small. And that matters.

For Japan to rise again, not in legend but in reality, it must do more than invest abroad. It must choose to reform at home, to cut the old habits that no longer serve, to open the windows, let in the light, and cook something new with courage.

The world remembers what this chef was capable of. It’s time he remembered, too.

Editor’s Note: To celebrate the passage of the tremendous One Big, Beautiful Bill, we’re offering a fire sale on VIP memberships!

Join us in the fight against the radical left today and support our reporting as President Trump continues to usher in the Golden Age of America. Use promo code POTUS47 at checkout to get 74% off!