Senate Republicans are poised to end an abbreviated workweek in Washington Wednesday without having locked down enough support to pass President Trump’s One Big Beautiful Bill ahead of a potential floor vote next week.

The issues GOP leaders have to resolve to get at least 50 of their 53-member conference to support the legislation (Vice President J.D. Vance can break a tie) are numerous.

They range from fiscal hawks’ broad frustration about the measure’s deficit impact to more nuanced concerns from senators about the effect that cuts to Medicaid and other programs would have on their states.

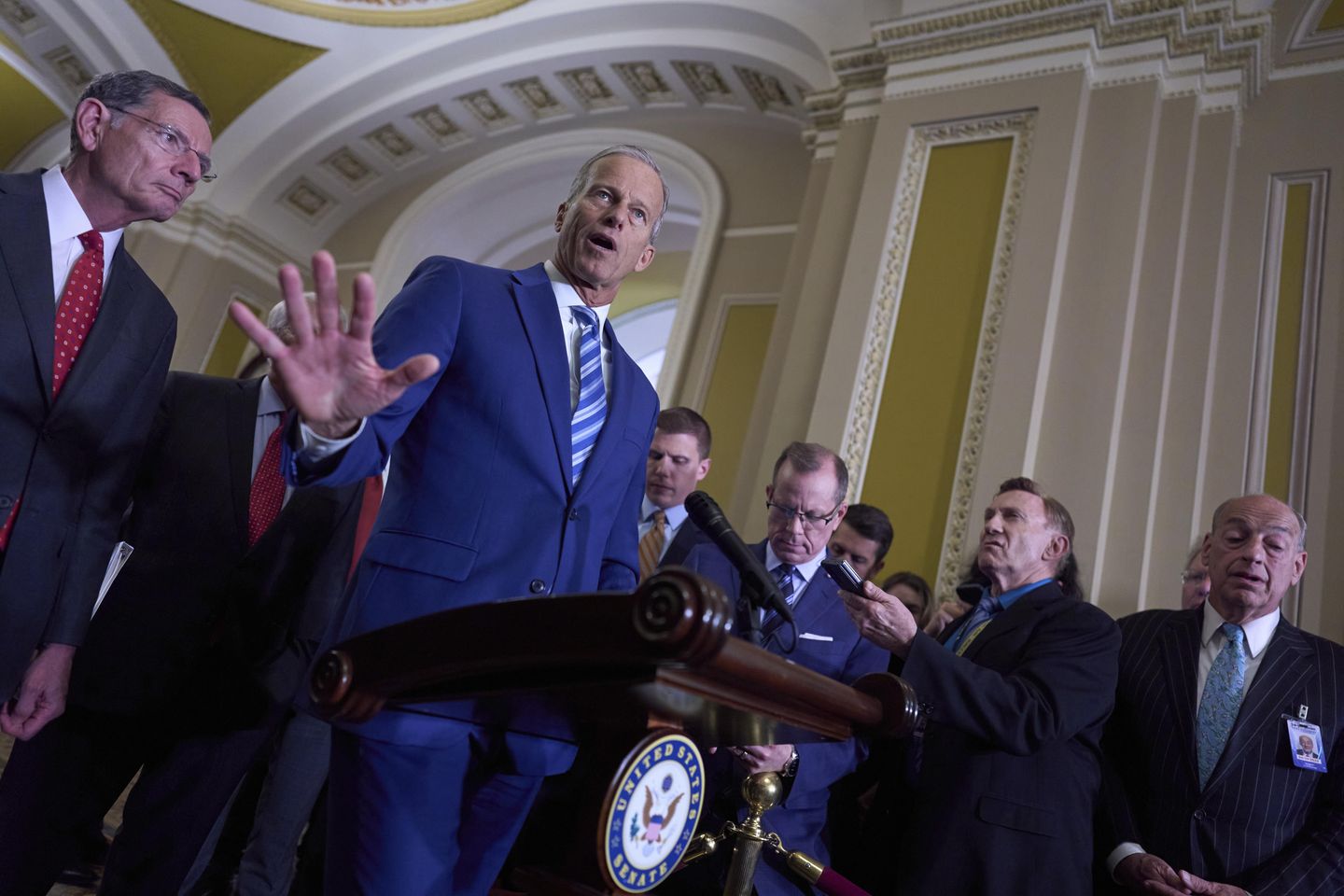

“We are in conversations with all of our members,” said Senate Majority Leader John Thune, South Dakota Republican.

Wisconsin Sen. Ron Johnson and other GOP fiscal hawks like Sens. Mike Lee of Utah and Rick Scott of Florida are still pushing for steeper spending cuts in the bill.

“We need more time,” Mr. Johnson said.

Republican Sens. Josh Hawley of Missouri, Susan Collins of Maine and Lisa Murkowski of Alaska have various concerns about the Medicaid reforms in the bill.

Mr. Hawley is leading a crusade against a change that would limit taxes on health care providers to finance their share of Medicaid because he’s concerned it will reduce funding for rural hospitals.

Republicans are targeting what they call a money-laundering scheme in which states use their provider tax revenues to increase Medicaid payments to the same providers, which then inflate the cost of their Medicaid programs and the share that the federal government must contribute.

A 1991 law sought to crack down on the practice by prohibiting states from guaranteeing providers would be “held harmless” and receive their money back from the taxes. But current federal regulations say that requirement doesn’t apply if the provider tax on net patient service revenues is 6% or less, which is known as the safe harbor limit.

The Senate bill would gradually lower the safe harbor limit to 3.5% by 2031 for the 40 states and the District of Columbia that opted to expand Medicaid under Obamacare to include low-income, able-bodied adults without dependents earning up to 138% of the poverty level.

Those states receive a 90% federal contribution to cover additional beneficiaries from the expansion and thus are more incentivized to use higher provider taxes and return payments allowed under the safe harbor to inflate the amount of funding they receive from the federal government.

Dr. Mehmet Oz, the head of the Centers for Medicare & Medicaid Services, said after a lunch meeting with Senate Republicans on Tuesday that states dramatically increased provider taxes once it became clear they could “game the system.”

He argued “there are better ways” for states to finance their Medicaid programs that would ensure money is “spent wisely in a very transparent way.”

Mr. Hawley said Missouri officials are telling him the Senate provider tax change would lead to a $1 billion annual reduction in Medicaid funding flowing to hospitals.

“I’ve got 35 hospitals, rural hospitals right now that have fewer than 25 beds, and over half of those are currently in the red,” he said. “So I don’t want to see any of those close. We already had a bunch of rural hospital closures.”

Mr. Hawley has raised the issue directly with the president, who told him “that doesn’t sound good” and that he “really didn’t want to do any more Medicaid cuts at all, over and above what the House did.”

The House bill would require states to freeze their Medicaid provider tax rates but didn’t touch the safe harbor limit. The Senate bill freezes rates for nonexpansion states.

Mr. Oz said the administration doesn’t have a preference between the House and Senate approaches but that neither would affect the viability of rural hospitals.

“In fact, the provider tax and the state-directed payments are often used to pay institutions that have the best connections to the government of the state, not necessarily the hospitals that need the help the most,” he said.

Mr. Hawley said he’s offered various suggestions to GOP leaders, like a carve-out for rural hospitals or a separate fund to keep them afloat, that could help earn his support.

Sen. Jim Justice, West Virginia Republican, is also opposed to the Senate proposal to lower the safe harbor limit and said he’d prefer the House’s approach in freezing provider tax rates.

Yet he wouldn’t go as far as to say he would vote against the legislation if the provision remains unchanged. He suggested he and other Republicans will ultimately have to compromise and accept some policies they don’t love to secure their larger priorities, like sweeping tax cuts.

“You may have to hold your nose on some things that you just absolutely don’t like, because we can’t like everything,” he said.

Other senators are largely pleased with the way the bill is shaping up but are still pushing key tweaks.

Sen. Thom Tillis, North Carolina Republican, wants further changes to the phaseout of clean energy tax credits, which the Senate measure mostly slows down from the House version, per his and other senators’ insistence.

And Sen. Mike Rounds, South Dakota Republican, is pushing to tighten language letting government-owned spectrum be sold at auction for commercial use. He wants to ensure certain bands of spectrum are set aside solely for Defense Department use and said there’s a provision in the bill “which makes that questionable.”