Iowa on Wednesday became the first state to receive a waiver from federal education spending rules, boosting a Department of Education campaign to reduce bureaucratic control over school funds.

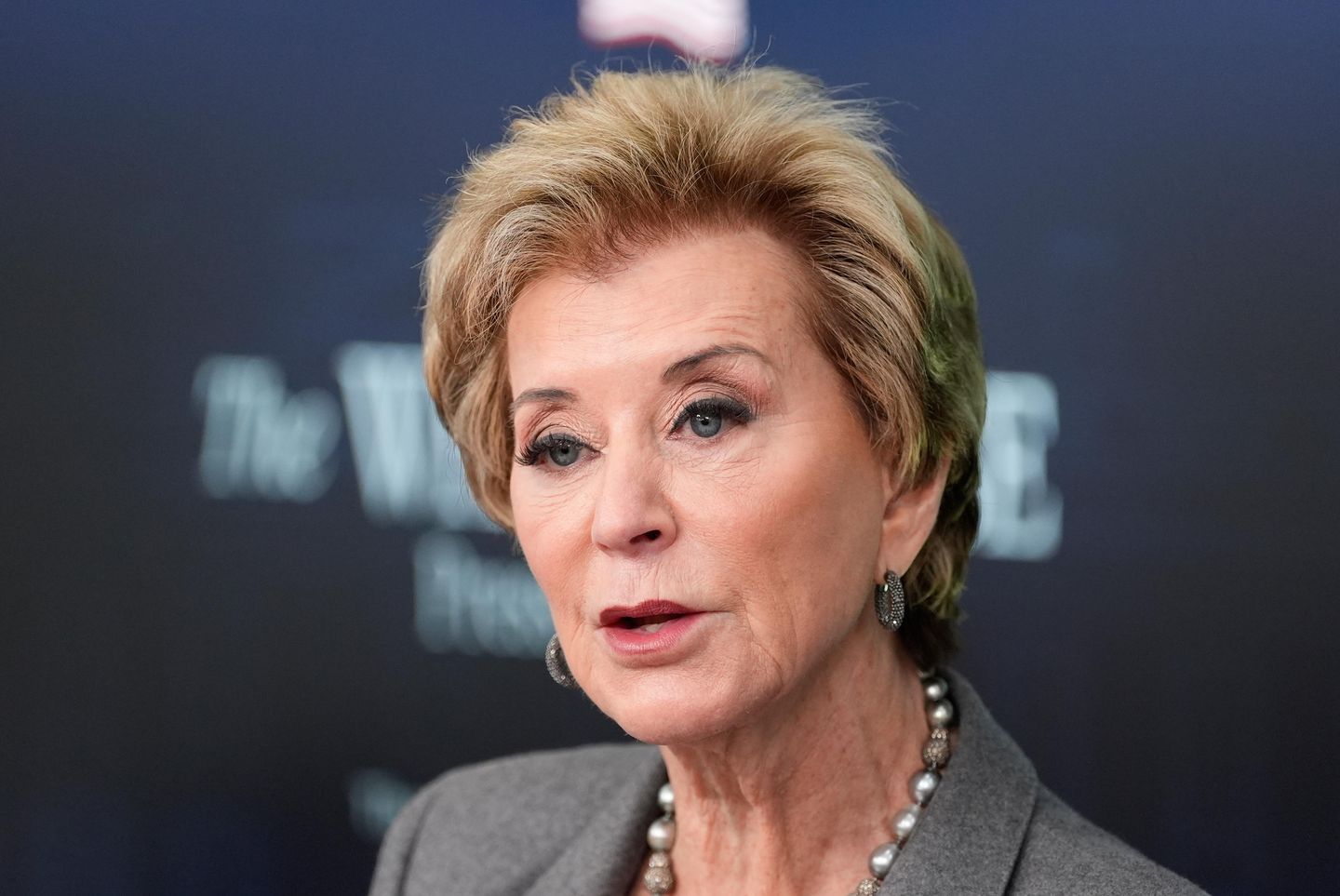

Education Secretary Linda McMahon said at an event with state leaders that the waiver allows the Iowa Department of Education to redirect nearly $8 billion over the next four years.

“Iowa now has the flexibility to cut paperwork and simplify 100% of state activities’ funding streams,” Ms. McMahon said. “It can invest in proven strategies to build a world-class teacher pipeline, close achievement gaps, and open post-secondary opportunities to prepare for a great career.”

Iowa was the first state to apply last year when the federal agency offered waivers.

Republican Gov. Kim Reynolds said Iowa’s waiver reallocates funds earmarked for ensuring compliance with federal rules into a block grant that will shift “thousands of hours of staff time from bureaucracy” to supporting classroom instruction.

“And most importantly, it means moving the dial toward the return of education to the states,” Ms. Reynolds said.

McKenzie Snow, director of the Iowa Department of Education, said the funds will help strengthen “evidence-based reading and math instruction” resources.

Indiana and Kansas have applied for similar waivers, and other states have expressed interest in them.

The waivers are part of a broader Trump administration push to dismantle the Education Department and eliminate its influence over school spending.

In addition, Iowa this week became the sixth state to opt into a federal tax credit for donations to nonprofit scholarship funds that support low-income children attending the schools of their choice.

A provision in President Trump’s Big Beautiful Bill will let individuals deduct up to $1,700 per year in donations to state-approved nonprofits from their income tax returns starting in 2027 — but only in states that adopt the program.

Ms. Reynolds announced Monday that her administration would certify a list of scholarship funds.

The National Education Association and the American Federation of Teachers, the nation’s two largest teachers’ unions, did not respond to emails seeking comment.

Both unions have accused the White House of laboring to weaken taxpayer support for low-performing public schools.

The Trump administration has insisted that the federal tax credit serves only needy families, does not touch state or federal education funds, and still allows students to spend money on public school resources.

On Wednesday, Ms. McMahon praised Iowa’s adoption of the tax credit as a “momentous step to break away from top-down mandates and expand school choice” to “put students first.”

“This is a way to allow families to tailor their child’s education to what best suits them,” the education secretary said.

Tax credits

To date, 14 states have taken steps to accept or reject the federal tax credit program.

In October, Nebraska became the first to opt into it through an executive order from Republican Gov. Jim Pillen. In the following months, Texas, Tennessee, Colorado, and South Dakota all followed suit before Iowa signed on.

The Republican-controlled North Carolina General Assembly passed a bill opting into the tax credit, but Democratic Gov. Josh Stein vetoed it in August.

Mr. Stein said in his veto message that he intends to opt into the program “once the federal government issues sound guidance” on how to spend the funds on “public school students most in need.”

Oregon, Wisconsin and New Mexico rejected the program.

As of this month, the National Conference of State Legislatures reports that lawmakers in six other states have introduced legislation to adopt the federal tax credit: Illinois, Indiana, Vermont, Wisconsin, Pennsylvania and New Hampshire.

The remaining 34 states have taken no steps in either direction.

“Most states are waiting for the U.S. Treasury to issue regulations for the program,” said Patrick Wolf, a University of Arkansas education reform professor.

Norton Rainey, CEO of ACE Scholarships, a Colorado private school fund supporting needy families in 13 states, said a turning point occurred when Democratic Gov. Jared Polis added his state to the program last month.

“This law is expanding faster than expected,” Mr. Rainey said Wednesday. “At first, skeptics said no Democrat would opt in.”

The Congressional Budget Office projects that $4 billion in tax credits will be claimed annually under the federal tax credit.

However, the final amount that lands in students’ pockets will depend on how federal agencies regulate the program.

The conservative Club for Growth submitted comments last month urging the Treasury Department and IRS to adopt a “broad interpretation” that maximizes deductions for married couples and limits “bureaucratic influence” over how families spend the money.

“The difference in approach to regulations could mean tens of billions of dollars,” Club for Growth President David McIntosh, a former Indiana Republican congressman, said in an email.

Officials at Arete Scholars, a nonprofit that distributes scholarships to 3,500 children at 350 private schools in Georgia and Louisiana, insist that more states will opt for the credit once they understand it.

“The federal scholarship program’s intent is impartial about where a child is educated, whether in traditional public schools, private schools, charter schools, homeschools, or otherwise,” Arete President Arthur Dupre said Wednesday in an email. “It is focused on simply helping families access a learning environment that best fits their child.”

The American Federation for Children, a school-choice advocacy group, praised Ms. Reynolds’ leadership this week.

“Iowa joins the movement to embrace expanding school choice even further, setting the stage for a golden age in American education in Iowa and beyond,” said Tommy Schultz, the federation’s CEO.