There are lots of things to hate about Biden’s tax proposal. In fact, there is nothing to like about it at all.

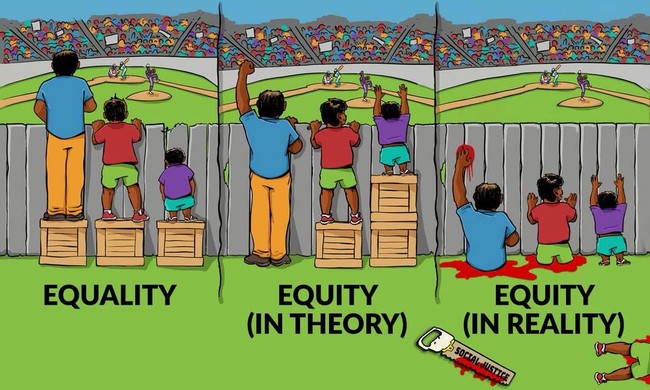

But the most interesting aspect of it is not any one proposal–all of them are terrible–but the rationale put forth by the Department of the Treasury: it is all about Equity. Redistribution of wealth. Strangling economic growth.

And “getting” Whitey. That’s a big part of it, and they say so.

Equity is pretty much the only explanation for the content of the proposals because each tax code change will substantially damage the economy. The biggest and most discussed change will be doubling the Capital Gains tax rate (even more than double for wealthier people), penalizing people for making investments, and cutting into the value of equity in assets. There is also a huge increase in the inheritance tax, wiping away family wealth accumulation and destroying family businesses.

These proposals are economically insane, as any serious economist will tell you. They are a great way to put the brakes on economic growth, impede the generational accumulation of wealth, destroy small business, and empower the government to control the economy.

It should come as no surprise that economic growth is not the goal of the Biden plan. The goal is to confiscate wealth from White people. Seriously.

For generations, entrenched disparities in our society and economy, at times facilitated by the Federal government, have made it harder for Americans of color to have access to opportunity. These disparities are starkly reflected in racial wealth gaps. Despite a robust increase in wealth for Black and Hispanic families between 2019 and 2022, the wealth gap between White families and families of color remains very large (Bowdler and Harris, 2022; Derenoncourt et al., 2023). Median wealth among White families in 2022 was $285,000, compared to $61,600 for Hispanic families, and $44,900 for Black families (Aladangady et al., 2023). While the Federal individual income tax, taken as a whole, is progressive, meaning that it reduces income inequality, some elements of the tax code exacerbate differences in income and wealth accumulation by different racial groups, leading to greater inequality (Holtzblatt et al., 2023). For example, Treasury estimates that 92 percent of the benefits of the tax expenditure for preferential rates on capital gains and qualified dividends accrue to White families. Only 2 percent of the tax expenditure accrue to Black families and 3 percent to Hispanic families (Cronin et al., 2023). A similar share of the benefits of the tax expenditure for the deduction for income from pass-through businesses accrue to each group.

Note the way that the Treasury describes tax rates lower than 100%: “tax expenditures.” That is a very complicated way of saying, “Any money we let you keep is actually the government giving you money.” We are not talking subsidies, tax credits, or any form of payment that comes from the government into your pocket, like the Earned Income Tax Credit, which indeed is an expenditure of sorts.

It simply means: “What is yours is mine, and if I let you keep it, it is an ‘expenditure’ of my money being transferred to the taxpayer.” In normal parlance a “tax expenditure” would be a tax credit–the government basically handing you money through the tax code for some policy reason.

However, in Biden’s parlance, a tax expenditure allows you to keep any part of your wealth or income. This is, of course, pure communism, as well as being morally wrong. It is a tyrannical assertion that everything belongs to the state.

And the state doesn’t like that White people are accumulating wealth in a manner that, statistically speaking, some minorities are not.

Allowing people to invest leads, statistically, to White families gaining more wealth than minorities, so that must stop. And the method that it will be stopped is seizing the wealth of White people, not encouraging minorities to invest and build wealth. In fact, to the extent that minorities do this through building businesses, saving for retirement, or anything else similar they will be subject to higher taxes as well.

The revenue proposals in the Administration’s Fiscal Year 2025 Budget (U.S. Treasury, 2024) would raise revenues, help ensure the wealthy and large corporations pay their fair share, expand tax credits for working families, and improve tax administration and compliance. They would reduce child poverty, make health insurance more affordable, and support the middle class by expanding refundable credits for low- and moderate-income workers and families. They would increase the fairness of the tax code by reforming the taxation of high-income taxpayers to help ensure more equal treatment of income from work and income from wealth. And they would reduce the ability of wealthy individuals to avoid paying capital gains taxes on assets that have increased in value when those assets are passed to heirs. These proposals, in combination, would lift up families, make sure that the most fortunate among us pay their fair share, and reduce income inequality. These proposals would also increase the fairness of the tax system by addressing some of the features that have historically reinforced racial disparities. Over time, these proposals are expected to increase wealth accumulation by low- and middle-income families and reduce racial wealth gaps.

The Biden proposal makes the remarkable claim that poorer families will be made better off–this is only so, however, if they don’t accumulate real wealth. It will be through genuine tax expenditures that take money from wealthier people, especially accumulated through investments that gain value only through an expansion of the economy, and giving it out as credits to poorer people.

Make sure the pie doesn’t grow and redistribute what is left. Somehow, that is supposed to be a good long-term strategy for minorities’ wealth accumulation.

Of course, it isn’t. It is the opposite, probably partly motivated by the “degrowth” agenda adopted by the WEF and transnational elite.

Treasury found that most of the top tax expenditure categories disproportionately benefited White families relative to Black, Hispanic, and other racial/ethnic groups. One of the most salient results comes from how income from work is taxed differently than income from wealth. Capital gain income from assets held for more than one year and qualified dividend income are taxed at rates no higher than 20 percent (plus a 3.8 percent net investment income tax [NIIT] on high income taxpayers). In contrast, income tax rates on labor income vary between 10 percent and 37 percent (plus 3.8 percent in Medicare taxes). Treasury estimated the benefit of this tax expenditure for preferentially lower rates on certain capital gain and qualified dividend income to be $146 billion for 2023 (U.S. Treasury, 2023) and that 92 percent of the benefits – $135 billion – accrued to White families. Roughly 2 percent went to Black families, and roughly 3 percent went to Hispanic families. In contrast, White families account for 67 percent of all families; Black and Hispanic families account for 11 percent and 15 percent of all families, respectively. Even within the top 5 percent of the income distribution, the average benefit for those with a benefit “range[s] from $16,900 for Hispanic families to $20,600 for Black families and $24,300 for White families” (Cronin et al., 2023). Thus, the preferential rates amplify the underlying differences in income received by different families, with Black and Hispanic families being disproportionately disadvantaged. This naturally has follow-on consequences regarding wealth accumulation, compared to a tax system that would raise the same amount of revenue in a more equitable manner. How individuals hold their wealth looks very different across racial and ethnic lines.

Tax rates for income and for wealth differ not because of a desire to give White people a break on their taxes. They exist because investment and income are two very different things, and investment is the lifeblood of the economy, and wealth accumulation is a very good thing. It represents deferred consumption and the ability to climb the economic ladder–ensuring the next generation is better off than the last.

These are key components of the American Dream, and Biden wants to crush the American Dream. That is the only possible goal of this proposal. Strangling investment means nothing less than handing over to the government the ability to choose which parts of the economy grow and which shrink–after all, private entities and individuals are discouraged from making investments, so government subsidies take the place of investment.

We see this taking place already in the energy sector as well as transportation, and this proposal will double down on that approach. The goal of the tax credits for lower-income people is to prevent the accumulation of future wealth on their part while temporarily buying political support by distributing checks.

That is Venezuelan economics. Chavez and Maduro remained popular so long with the lower classes through precisely these political maneuvers, and you can see the results.

Biden’s tax proposal has remained mostly under the radar, except with investors, because Biden’s gaffes and Trump’s trials have been shiny objects distracting us.

But make no mistake; they are an absolute disaster.