TLDR:

- Congressional watchdog finds tens of thousands of dead people’s Social Security numbers collecting Obamacare subsidies

- Investigators filed fake applications with bogus documents — most were approved and are still receiving benefits

- One Social Security number was used for 125+ claims worth 71 years of coverage in 2023 alone

- Findings undercut Democratic push to expand the $124 billion program that sparked record 43-day government shutdown

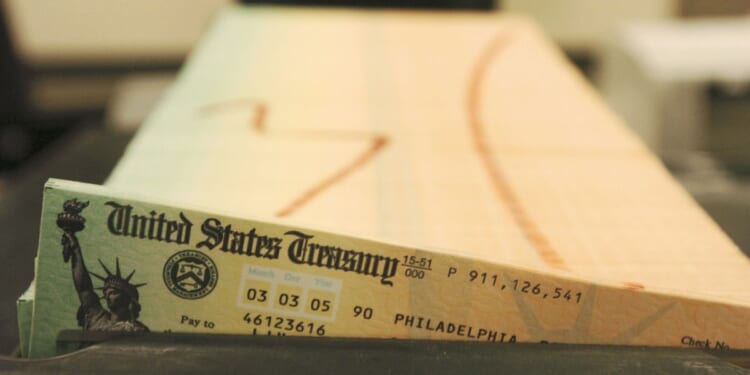

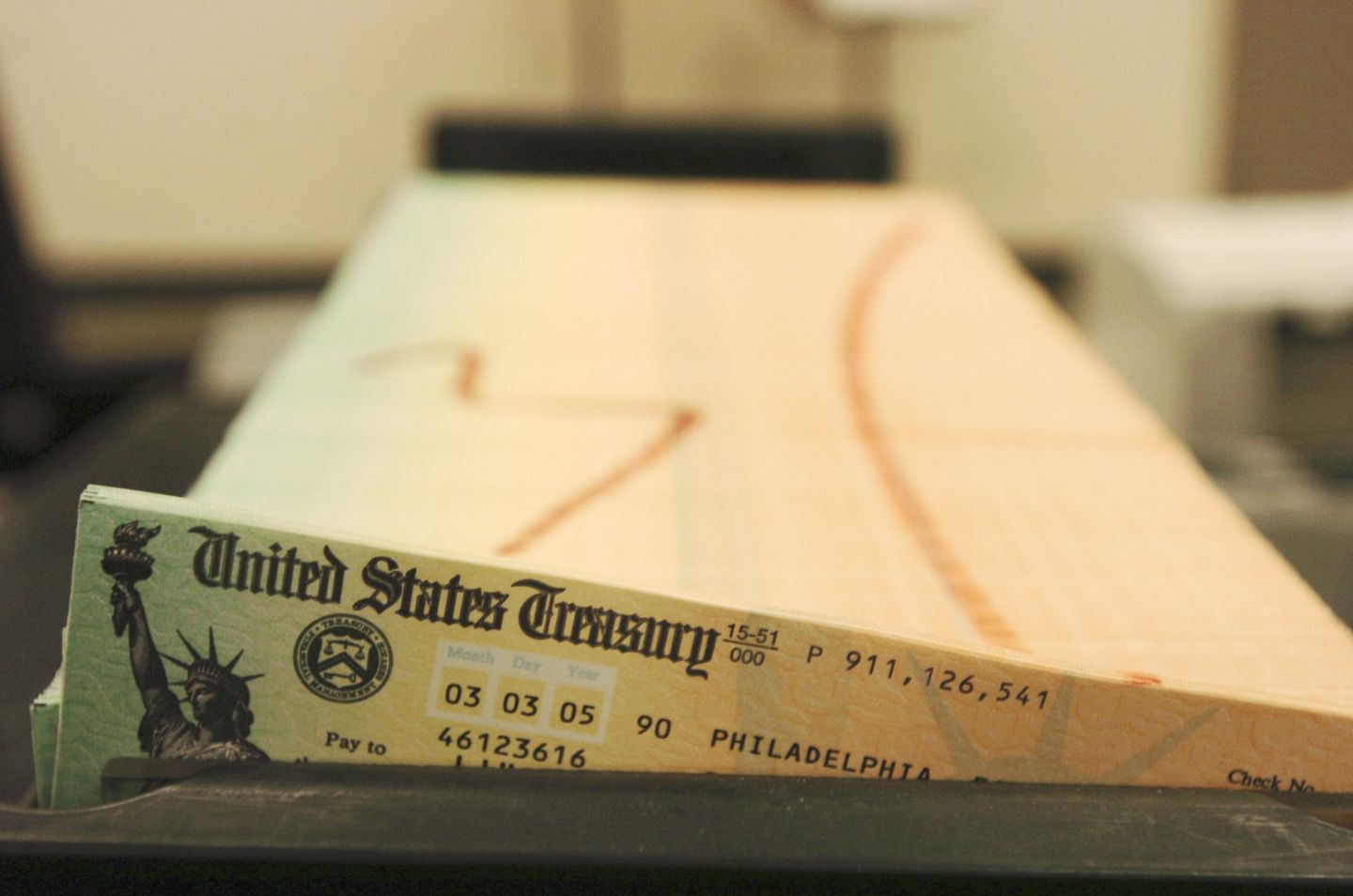

Dead people are collecting Obamacare subsidies, and fake applications are sailing through the system with little scrutiny, according to a bombshell report from Congress’ chief watchdog.

The Government Accountability Office found tens of thousands of Social Security numbers belonging to people the agency believed were dead were receiving benefits from the Advance Premium Tax Credit program. Investigators also discovered rampant double-dipping, with tens of thousands of numbers claiming more than 365 days of benefits in a single year.

In one extreme case, a single Social Security number was used for more than 125 claims — worth over 71 years of health coverage in 2023 alone.

GAO investigators filed their own bogus applications to test the system. Most sailed through, even when backed by fabricated documents. In one instance, fake proof of citizenship was “verified” by the government.

As of September, 18 fraudulent test applications were still active, collecting more than $10,000 monthly in taxpayer-funded payments.

The findings arrive as Democrats demand expansion of the program, which cost nearly $124 billion in 2024. The party forced a record 43-day government shutdown over extending pandemic-era subsidies set to expire this year.

“There is absolutely no justification for perpetuating these subsidies,” said Rep. Jodey Arrington, chairman of the House Budget Committee.

Read more:

• Audit finds dead people, fabricated applications collected Obamacare tax credit

This article is written with the assistance of generative artificial intelligence based solely on Washington Times original reporting and wire services. For more information, please read our AI policy or contact Ann Wog, Managing Editor for Digital, at awog@washingtontimes.com

The Washington Times AI Ethics Newsroom Committee can be reached at aispotlight@washingtontimes.com.