I am under no illusion that more than a handful of PJ Media readers will bother to peruse my latest effort to write about the national debt.

It’s not that most readers don’t care. It’s just one of those subjects that most people think can safely be pushed away in our conscious minds to some future date when we have the time to think about it.

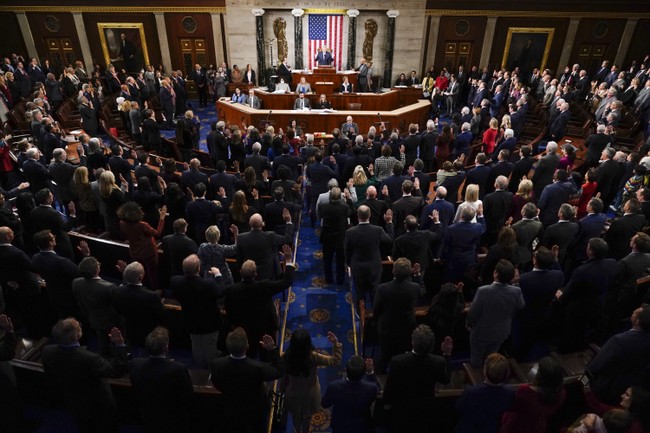

For those who wish to be informed about this issue, I congratulate you. It puts you miles ahead of most members of Congress and members of the executive branch.

There”s a reason for that. Getting control of the debt will take a national will to do it. And, right now, there is no will to get control of anything in the government. At the bottom, Congress and the president are political cowards who know that doing the right thing about the national debt means cutting popular programs and raising taxes.

The left thinks that all we have to do is raise taxes on the rich. The right thinks all we have to do is cut entitlements and other programs for the poor and Middle Class. There’s no way to get a handle on the debt except to both cut spending and raise taxes. Here’s why.

Over the Christmas holidays, the national debt broke $34 trillion. Don’t bother trying to wrap your head around that figure because humans weren’t meant to understand $34 trillion except in the abstract.

Unfortunately, the debt isn’t an abstract formulation. It’s very, very real and unless we radically change course, we’re going to see how real it gets.

A much more intellectually approachable number is the amount of money we spend on servicing the debt. We spend $659 billion in interest payments on the debt. That’s the fourth highest expenditure in the federal budget; only national defense, Social Security, and Medicare cost us more. In a few years, we will be spending more than $1 trillion to service our debt and it will be the largest line item in the budget.

That trillion dollars is buying absolutely nothing except paying off Wall Street bankers, Chinese, Japanese, and German debt holders. No tanks, no planes, no houses, no roads, no nothing.

Two-thirds of the budget is spoken for without a vote in Congress, thanks to entitlements. That leaves one-third that both parties go to war over every few months. As the government makes more and more spending part of entitlements, that discretionary spending pie is divided up into smaller and smaller pieces.

Senators Joe Manchin, Mitt Romney, and Reps. Bill Huizenga and Scott Peters wrotean op-ed about one possible way to address the debt problem.

We have proposed the establishment of a bipartisan, bicameral fiscal commission tasked with finding solutions to strengthen our fiscal health and meaningfully decrease the national debt. This 16-member commission would consist of 12 members of Congress and four outside experts, equally appointed by congressional leaders.

This commission would look at the federal budget as a whole—closely examining both spending and revenue sources, leaving no stone unturned. It’s important to note that there are no preconceived outcomes and any proposal recommended by the commission would require bipartisan support to advance. Our commission has been adapted to overcome challenges encountered by Simpson-Bowles in 2010 by having an established process for a potential proposal to receive expedited consideration in both the House and Senate, while maintaining the 60-vote threshold in the Senate ahead of final passage.

A debt commission was tried in the 1980s with the so-called Grace Commission. But it operated when the national debt was “only” $1.1 trillion. The task ahead of any commission formed to look at ways to reduce our debt is much more difficult and would be operating in the most toxic political climate since the antebellum Congresses where members brought dueling pistols to the floor.

It’s no longer a question of whether it can be done. It must be done or our grandchildren won’t have much of a country to live and work in.