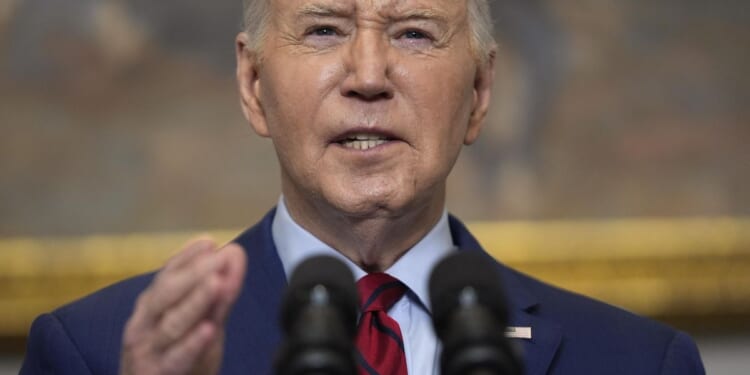

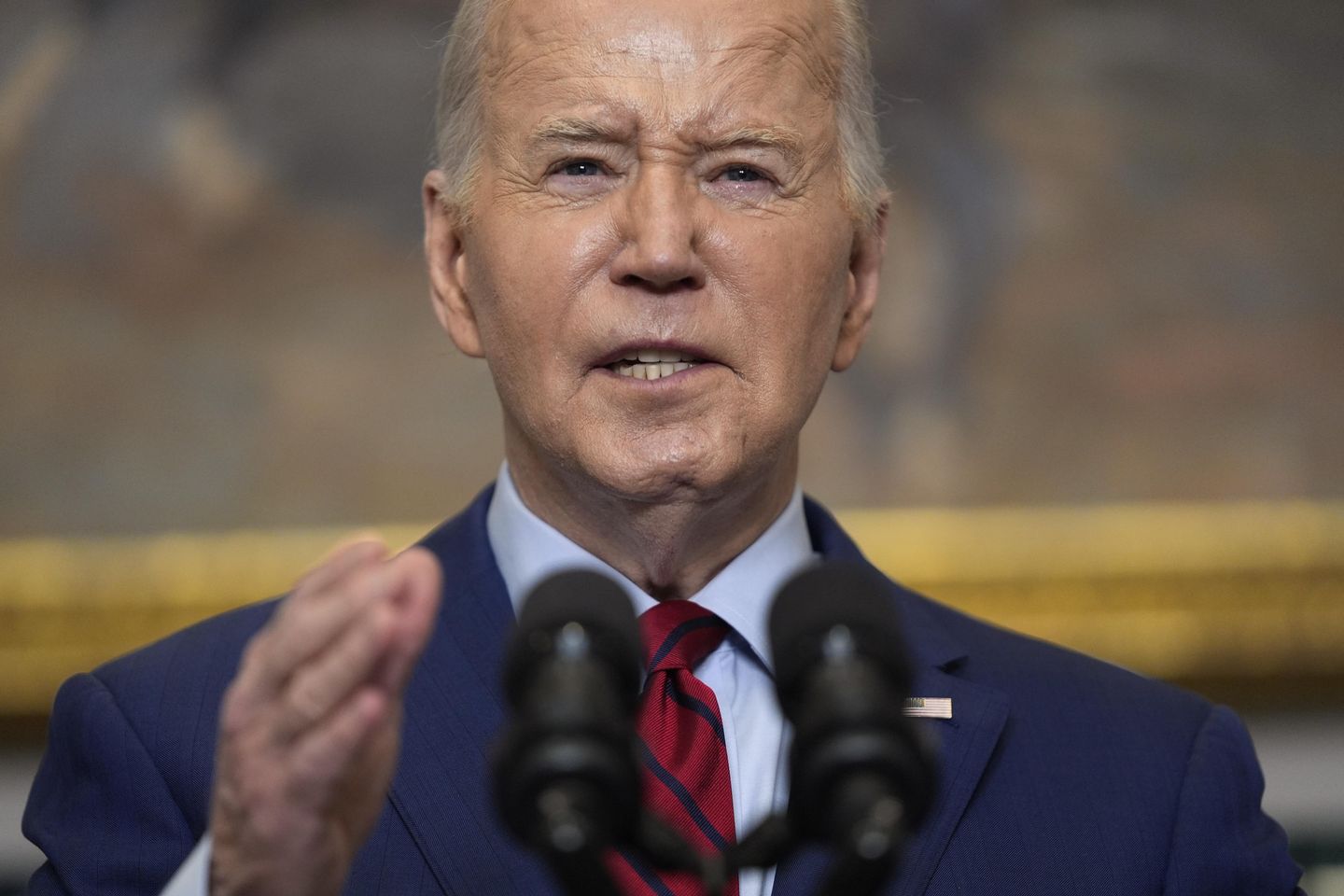

Politicians often bet big on promising tax cuts to get elected. President Biden is letting it ride on tax increases.

He has called for Congress to kill Trump-era tax cuts — “If I’m reelected, it’s going to stay expired,” he said — and he has announced plans to impose a spate of new levies. They include hiking income taxes, taxing unrealized capital gains and creating a Billionaire Minimum Income Tax.

The catch, Mr. Biden says, is that they’ll only touch the wealthy. Taxpayers making less than $400,000 will be spared from the pain.

He’s tapping into an us-versus-them sentiment growing in U.S. politics for years.

“It is a popular message,” said David Paleologos, director of the Suffolk University Political Research Center. “Given that the income inequalities are widening, it seems like the only dynamic that levels that playing field is a stock market crash, and no one wishes on that, but in terms of policy, being an ally of those people … who make under $400,000 is a good side to be on.”

Mr. Biden makes no bones about his goal of punishing the rich, figuring to have the government use the money to expand the social safety net.

For decades, that was a losing argument. But Gallup tracking polls showed things changed about 15 years ago when Americans became more open to redistributing wealth vis-a-vis heavier taxes on the rich.

Pew Research Center, in its most recent polling, found six in 10 adults “are bothered a lot by the feeling that some corporations and wealthy people don’t pay their fair share.”

Some 65% backed raising taxes on large corporations and 61% supported raising taxes on households with annual incomes over $400,000.

Mr. Paleologos said Mr. Biden‘s message is particularly attractive to independent voters, who see the economy and inflation as their chief concern, compared to Democrats who are focused on threats to Democracy, and Republicans whose chief concern is immigration.

“That is really what this is all about,” he said. “With 26 weeks left before the election you want to play to the groups that matter, and when you look at the data, it is pretty convincing that if you are Biden or if you are Trump and you need independent voters, that is your issue.”

Mr. Biden‘s menu of tax hike proposals includes:

• Increasing income tax bracket to 39.6 percent from 37 percent for individuals making over $400,000 and families making over $450,000.

• Establishing a Billionaire Minimum Income Tax law that would require the wealthiest American households to pay a minimum of 20% on all of their income

• Raising the corporate tax rate to 28% from 21%.

• Raising the long-term capital gains tax for top earners from 20% to 39.6% and establishing a 25% tax on unrealized gains on people with wealth greater than $100 million.

That latter idea has sparked intense debate on Capitol Hill, where Democrats say something must be done to stop the ultra-wealthy from borrowing against their assets and then wiping the slate clean when they pass their estate using what’s known as stepped-up basis.

Taxing unrealized gains would get at that.

Opponents argue it could be unconstitutional, and would quickly ratchet down to include unrealized gains for those lower on the income chart.

They point to the advent of the income tax in 1913, intended to force the wealthy to pay up. It applied to only a tiny percentage of Americans and started with marginal rates starting at 1% of income. Less than 1% of the population paid income taxes.

By 1919 the top tax rate was 77%.

Republicans warn that Mr. Biden won’t constrain higher taxes to the wealthy. They pointed to a social media post where Mr. Biden complained about the tax cut package President Trump won from Congress in 2017.

“That tax cut is going to expire,” Mr. Biden said. “If I’m reelected, it’s going to stay expired.”

His aides say he was speaking about the part of the package that lowered the corporate income tax rate and cut rates for individuals at the high end. Mr. Biden says he will stand by his $400,000 dividing line between the rich and everyone else.

Mr. Trump warned supporters at a campaign event that Mr. Biden plans to “drench the middle class” in higher taxes.

“It will mean you have the biggest tax increase in the history of the nation,” Mr. Trump said.

Grover Norquist, president of Americans for Tax Reform, a conservative think tank, said Mr. Biden is selling voters on a “fantasy world” where only rich people and corporations are forced to pay more to the government.

“He is talking to an audience that thinks of themselves as tax consumers — not taxpayers,” Mr. Norquist said. “The applause is not coming from people who pay taxes.”

Mr. Norquist said that in reality, it is workers, consumers and retirees who will bear the brunt of higher taxes on corporations.

“Some people will cheer because they listen to NPR when they say this will not affect you,” Mr. Norquist said. “I think Biden hopes to use the old lies that have worked in the past: ‘I am not taxing you, I am just taxing the rich.’”

That fight has already played out with Mr. Biden‘s battle to win $80 billion in new money for the IRS as part of his 2022 budget-climate bill. He vowed to use the money to surge audits for the wealthy while not increasing audit rates for those making less than $400,000.

So far, the IRS says, it has maintained that divide, with new pressure on millionaires to pay up, even as those at the lower rungs continue to see historically low audit rates.