“You can’t fight City Hall,” we used to say, assuming we were living in a movie from the 1930s. Kidding aside, the old expression was for venting frustration at the odds of a lone citizen going up against bureaucrats who care more about filling out the proper forms than serving their communities.

But what happens when City Hall goes up against Wall Street? Or in today’s case, when Communist Chinese control freaks displease the millions of investors who participate in global stock markets?

It’s game over, man — game over!

Feng Shixin isn’t a name I’d ever heard before today, but it was with some interest that I read about his handiwork in the days before Christmas. I would have written about it then but my wife and I both caught the Death Flu and, more than a week later, everything still tastes like mucus.

Pardon the disgusting digression.

Until this week, Feng served as head of Communist China’s confusingly named Publicity Department, which is the regulator overseeing the country’s gaming industry. Feng has stepped down — or more likely, been forced out — not even two weeks after announcing tough new rules to curb spending on video games.

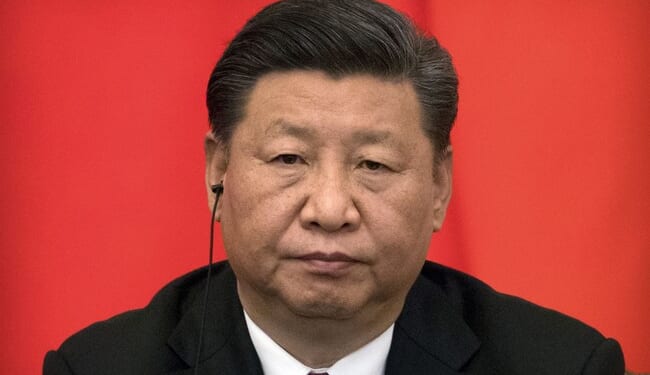

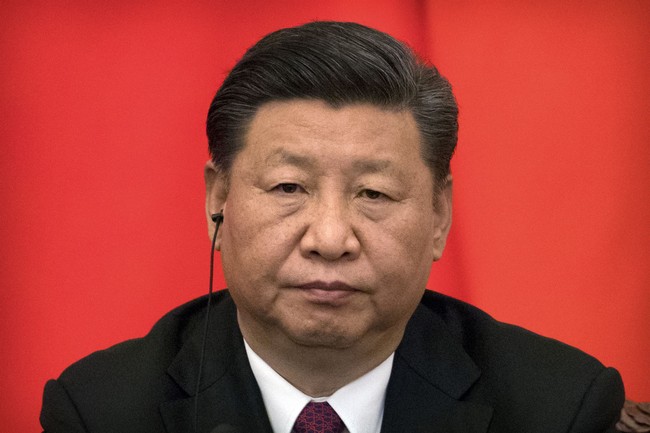

With 1.4 billion people, China is the world’s biggest gaming market — and Communist busybodies really don’t like people (particularly young people) staring at anything too long that doesn’t feature the beaming smile of Communist Party boss Xi Jinping. So under Feng’s new rules, Reuters reported that “online games will now be banned from giving players rewards if they log in every day, if they spend on the game for the first time or if they spend several times on the game consecutively.”

The markets’ reaction was as swift as it was brutal, “wiping off nearly $80 billion in market value from China’s two biggest gaming companies,” Tencent and NetEase, the first trading day after the rules were announced. Worse, the selloff provoked broader concerns about Beijing’s decreasing regard for free markets and Xi’s love of increasing social credit-type controls over more and more aspects of Chinese life.

“It’s not necessarily the regulation itself — it’s the policy risk that’s too high,” explained UOB Kay Hian executive Steven Leung. “People had thought this kind of risk should have been over and had started to look at fundamentals again. It hurts confidence a lot.”

All of this happened even though Tencent claimed that the new rules wouldn’t much affect the company’s bottom line.

So, “Hey, hey, ho, ho, Feng Shixin has got to go.”

Leung went on to tell Bloomberg this week that Feng’s removal “shows Beijing has become more concerned about economic sentiment after the post-Covid rebound proved much weaker than expected, and huge capital outflows from the equities market.”

That’s the fancy way of saying that the V-shaped recovery everyone expected China to enjoy after Xi finally abandoned his Zero-COVID Policy never materialized, and that the CCP can’t afford any more Communist busybody indulgences.

Here’s the thing, though. Feng might be gone, but his regulations remain — as does the Publicity Department’s authority to crack down on pretty much anything within its purview, pretty much any time the fancy strikes. Beijing got rid of one Communist but did nothing to rein in Xi’s appetite to reimpose more Communism wherever he’s able.

But as the markets’ reaction proves, you might not be able to fight the CCP, but the CCP can fight economic reality for only so long.

Recommended: We Need to Talk About That ‘Inevitable’ Switch to Electric Vehicles